Across North America, the electricity sector faces mounting cyber-physical threats. Increased digitalization of operational technology (OT), decentralized energy systems, and geopolitical uncertainty have expanded attack surfaces across utilities and co-ops. For electric cooperatives operating on limited budgets and dispersed networks, the challenge is not only defending assets but also quantifying exposure in financial terms that boards and insurers can act upon.

To address this, the National Rural Electric Cooperative Association (NRECA)—representing more than 900 electric co-ops serving 42 million Americans—has partnered with DeNexus, a leader in industrial cyber risk quantification. Together, they are delivering a data-driven framework that enables co-ops to measure, manage, and transfer cyber-physical risk across electricity transmission and distribution (T&D) systems.

Why Quantify OT Cyber Risk?

Traditional cybersecurity programs focus on compliance. Yet, compliance alone does not answer the board’s most critical question:

“What is our financial exposure if our OT systems fail?”

By adopting a risk-based cybersecurity approach, energy leaders can translate vulnerabilities into measurable outcomes such as expected loss and value-at-risk (VaR). These financial metrics give CISOs, CFOs, and boards a shared language for prioritizing investments, managing insurance portfolios, and evaluating the ROI of risk-mitigation strategies.

Translating Vulnerabilities into Financial Impact

Cyber-physical attacks on substations or SCADA systems can cascade through interconnected T&D networks—causing outages, equipment damage, or environmental penalties. Yet, many organizations still struggle to link these technical weaknesses to business consequences.

This is where DeNexus’ DeRISK™ platform transforms decision-making. Built for OT environments, DeRISK™ integrates telemetry, threat intelligence, and proprietary analytics based on MITRE ATT&CK to deliver quantified insights. The result: evidence-based cybersecurity that aligns engineering and finance functions, enabling executives to justify cybersecurity investments through data rather than assumptions.

Key Takeaway: Electric co-ops can now move beyond compliance toward quantified cyber resilience—using OT data and DeRISK™ analytics to prioritize controls, justify budgets, and align cyber risk with capital and insurance decisions.

NRECA and DeNexus: Building a Data-Driven Framework for Co-ops

NRECA’s mission is to strengthen electric cooperatives through shared innovation, research, and technology adoption. By collaborating with DeNexus, NRECA empowers its members—many of which are under-resourced rural co-ops—to access the same advanced cyber risk quantification (CRQ) capabilities as large utilities.

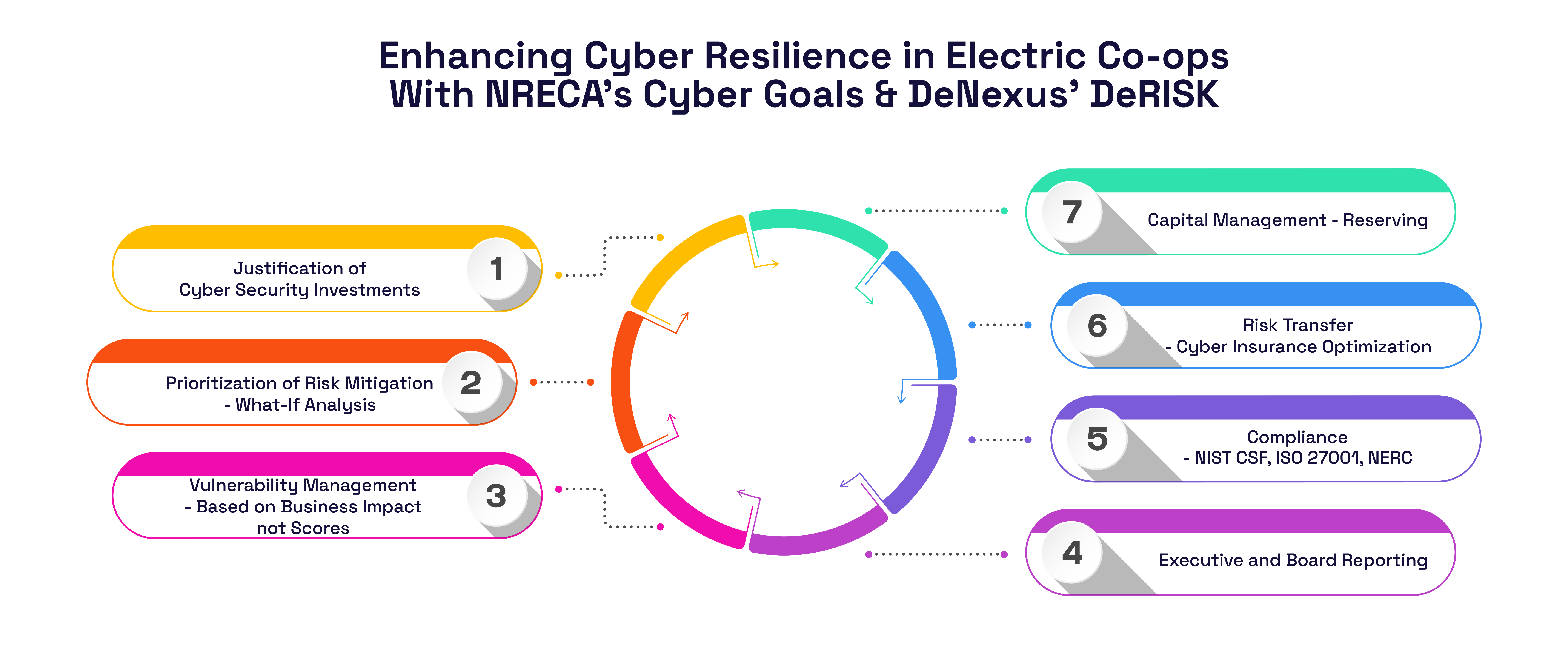

At the heart of this framework is DeRISK™ Quantified Vulnerability Management (QVM). The system ingests OT-specific data (e.g., transformer assets, relay configurations, telemetry) to model cascading failures and their downstream financial impact. Each output provides actionable intelligence on:

- Prioritization of Risk Mitigation: Scenario-based “what-if” analyses to assess potential outcomes.

- Vulnerability Management: Based on business impact, not technical severity scores.

- Compliance Alignment: Support for NIST CSF, ISO 27001, NERC CIP reporting.

- Risk Transfer Optimization: Insights for cyber insurance underwriting and policy design.

From Compliance to Confidence: A Risk-Based Future

Cyber risk in the electric grid is no longer theoretical—it’s a present and growing business threat. By embracing quantified vulnerability management (QVM) and cyber risk quantification (CRQ), electric co-ops can evolve from reactive compliance toward proactive resilience.

With accurate OT data and analytics, organizations can:

- Optimize cyber insurance through quantifiable risk metrics.

- Prioritize cybersecurity controls based on financial exposure.

- Enhance board-level reporting with evidence-based decision frameworks.

- Strengthen operational and financial continuity through risk transfer and capital management strategies.

A Call to Action for Energy Leaders

As cyber-physical systems become the backbone of modern energy distribution, understanding and quantifying risk is no longer optional—it’s essential to financial stewardship and regulatory trust.

Read the full feature in RE Magazine’s October 2025 issue to explore how NRECA and DeNexus are redefining cyber resilience for America’s electric cooperatives.

Or, take the next step in your own organization:

🔹 Request a demo of DeRISK™ QVM to see how quantified OT cyber risk data can transform your board’s decision-making.

🔹 Explore Cyber Risk Quantification (CRQ) for portfolio-level insight and insurance optimization.

Conclusion

By uniting NRECA’s mission to safeguard America’s electric cooperatives with DeNexus’ advanced industrial cyber risk quantification technology, the sector can finally bridge the gap between cybersecurity performance and business outcomes.

This partnership marks a pivotal step toward risk-based decision-making, board-level transparency, and long-term resilience in the energy ecosystem.

Further Reading: Learn more on NRECA’s Cyber Risk Quantification page →