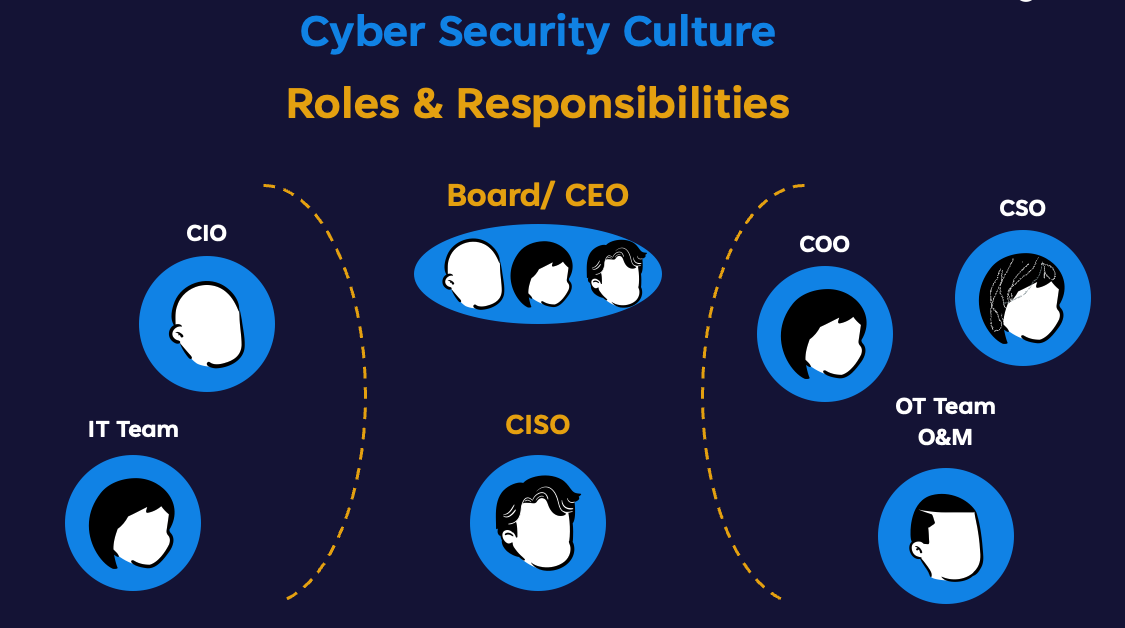

Effective cyber risk management involves various stakeholders, each with unique responsibilities and pain points. For example:

- Cybersecurity Team: Struggles to communicate technical challenges in terms business leaders understand.

- Chief Information Security Officer (CISO): Must demonstrate the business value of security initiatives and justify investments.

- Risk Manager: Needs to measure cyber risk in quantifiable terms and integrate it into overall enterprise risk management.

- Chief Financial Officer (CFO): Focuses on controlling costs and ensuring risk management efforts are cost-effective.

- Cyber Insurance Team: Aims to verify that insurance coverage matches the organization’s actual exposure.

- Board of Directors: Seeks assurance that cyber risks are understood, appropriately mitigated, and aligned with the company’s risk appetite.

The Communication Gap Without Quantification

Without a common risk language, these groups often talk past each other. Technical teams might report threats as high/medium/low, while executives think in dollars and business impact. This siloed communication can lead to minimal compliance-driven security (doing the bare minimum) instead of strategic risk reduction. In fact, organizations without a formal process to identify and prioritize cyber risks often misalign their security investments or underinvest altogether . The result is an enterprise where cyber risk is not fully understood across departments, causing gaps, redundant efforts, or misaligned priorities.

Cyber Risk Quantification: A Data-Driven Common Language

Cyber Risk Quantification (CRQ) offers a solution by translating cybersecurity threats into financial terms. Using measurable metrics like Annual Expected Loss (AEL), Value at Risk (VaR), and detailed loss scenario analyses, CRQ expresses risk in dollars. For instance, AEL provides an estimate of average annual loss from cyber events, while VaR (e.g. 95% VaR) indicates a worst-case loss threshold with high confidence. These metrics create a shared, data-driven language for all stakeholders. CRQ allows business leaders – from the CISO and risk manager to the CFO and board – to assess cyber risk in the same financial terms, establishing a common basis to prioritize projects and spending . In short, it bridges the gap between technical risk details and business objectives.

Addressing Stakeholders’ Concerns with CRQ

By quantifying risk, CRQ directly addresses each role’s concerns and aligns strategy enterprise-wide. The cybersecurity team and CISO can communicate the value of security controls by showing how they reduce expected loss or VaR, turning technical challenges into business cases. The risk manager gains consistent metrics to compare cyber risks with other risks, improving strategic decision-making. The CFO can evaluate cybersecurity ROI – seeing how a certain budget can lower AEL or prevent large losses – and thus control costs while avoiding surprise exposures. CRQ outputs also inform the insurance team: by revealing worst-case loss scenarios, they can determine if cyber insurance coverage is sufficient and adjust policies accordingly . Finally, the board of directors benefits from clear insight into the organization’s cyber risk posture (e.g. “our 95th-percentile annual loss is $X”) and confidence that investments are targeting the most significant risks. Each stakeholder can make informed decisions and jointly define what an acceptable level of risk is, using objective data rather than guesswork.

Enterprise-Wide Alignment and Strategic Action

Adopting CRQ fosters enterprise-wide alignment. It breaks down silos by ensuring everyone talks about cyber risk in terms of business impact. With a quantifiable risk outlook, organizations avoid purely checkbox compliance strategies and instead pursue risk-based security programs. Stakeholders can justify security investments with evidence and prioritize initiatives that reduce the most risk. Without CRQ, companies often lack this clarity – cyber risk remains abstract, leading to reactive or misaligned approaches. By leveraging CRQ’s financial metrics, the cybersecurity team, executives, and board can unite around a common understanding of cyber risk and coordinate their strategy to proactively manage it. This shared approach helps prevent underinvestment and ensures that cybersecurity efforts truly support the business’s objectives and resilience.

If you want to learn more, get in touch with our team, or understand how the above is put to use to quantify and manage cyber risks at 250+ industrial sites monitored by DeNexus, you can contact us at https://www.denexus.io/contact.